U.S. Refiners Rely on Permian Shale as Heavy Crude Supplies Dry Up

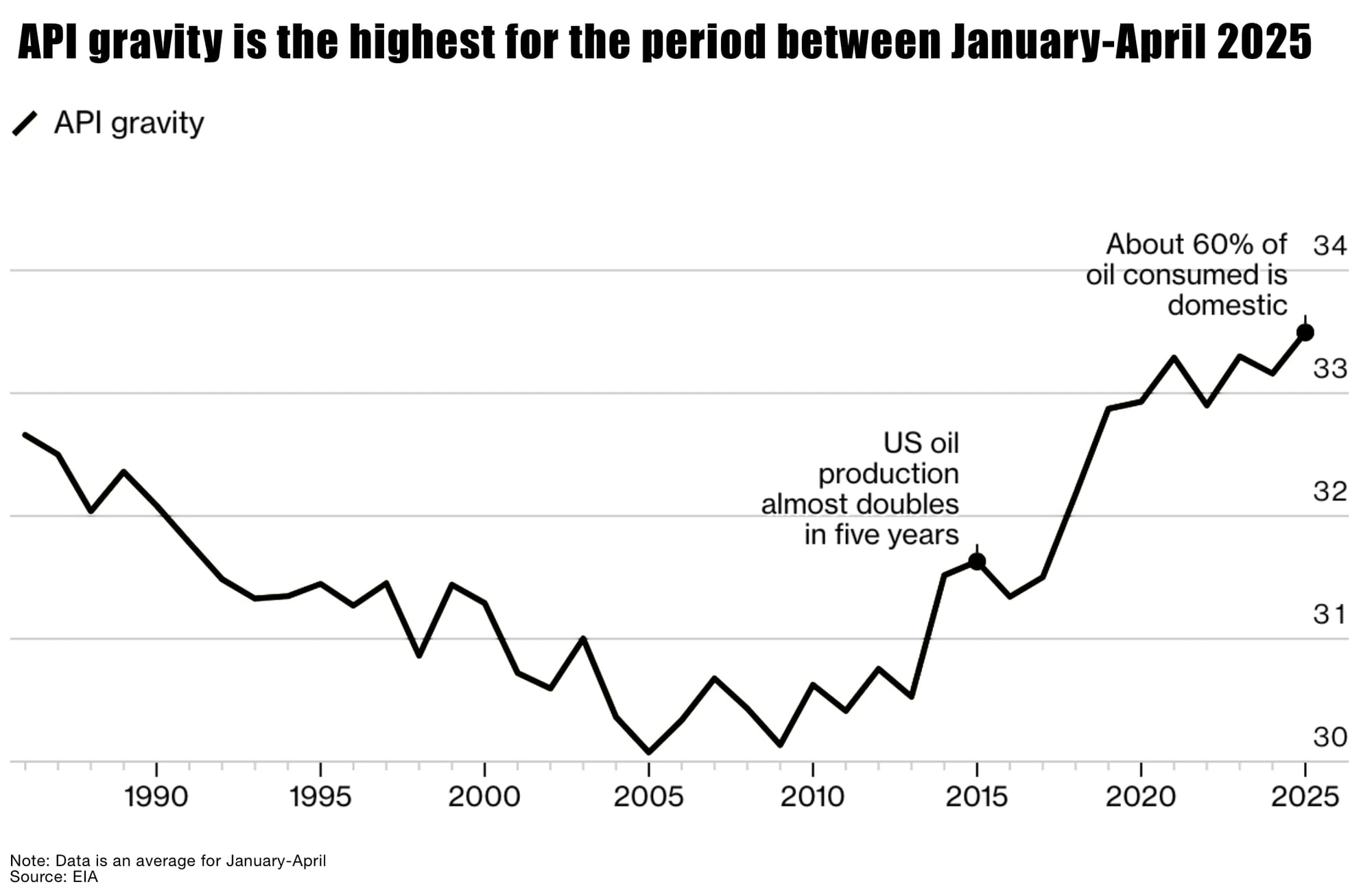

NEW YORK — U.S. refiners are increasingly leaning on Permian Basin shale oil to fill the gap left by dwindling heavy crude supplies, according to the US EIA. With limited domestic heavy oil and growing light crude volumes, refining plants are scrambling to adjust—and Permian light oil is becoming more valuable than ever.

⚠️ US at "strategic inflection point" on energy infrastructure with an increasing reliance on shale crude as heavy imports drop and shale’s share climbs, with the Permian playing a starring role.

Why This Matters for Permian Oil

- Refinery feedstock shift: U.S. refineries, historically optimized for heavy oil, are pivoting to lighter shale crude from the Permian to meet demand and run flexibly. In 2024, 61% of the oil used to make gasoline and diesel was domestic, a share poised to rise this year if shale supplies remain economical.

- Price premium upside: As demand for light oil grows, Permian grades may fetch a premium, tightening WTI differentials and boosting producer revenue.

- Drilling implications: With stronger prices, operators may gain confidence to reactivate rigs—even as U.S. rig counts remain near post‑2021 lows. Recent Dallas Fed data shows rigs at ~270 in the Permian.

Tariffs and counter-intuitive concerns

The American Fuel and Petrochemical Manufacturers warn that, counter-intuitively, tariffs and taxes that limit crude oil or refined product imports will raise costs for consumers and manufacturers, and also threaten U.S. energy security.

- Raising the cost of heavier crude oil would increase the cost of manufacturing fuel.

- Forcing refineries to process oil they weren’t designed for would cause them to reduce production and potentially shut down.

- Tariffs on North American imports could spur retaliatory actions and make our exports less attractive

Refinery Economics & Impacts

- Refinery limits: More than 70% of U.S. refineries are optimized for heavy crude, meaning switching to light shale requires costly retrofits and blending practices. A recent Reuters report warns big investments into new light crude refineries is unlikely.

- Shale’s light sweet advantage: Permian crude is low in sulfur and density, making it increasingly attractive for fuel and petrochemical markets. Analysts say this can narrow oil spreads and support WTI.

- Policy pressure: U.S. import bans on heavy crude from Canada and Mexico are tightening, adding urgency to maximize domestic shale runs.

What Oil Market Watchers Should Know

- Short-term bullish for Permian producers: Refinery demand may buoy WTI Midland pricing, encouraging operators to keep rigs idle but ready, or even roll them out.

- Midstream ripple effects: Expect increased demand for crude transport capacity out of West Texas, potentially raising takeaway costs—yet decent netbacks may offset the impact.

- Infrastructure race heats up: Refiners may accelerate investments in blending units and light-oil processing, which could extend the shale boom for years to come.

Bottom Line

As heavy oil flows taper, U.S. refiners are turning to lighter and sweeter Permian crude to sustain output. This trend has the potential to strengthen crude prices, lift oil rig utilization, and shape long-term drilling and infrastructure strategies in West Texas.