Trump-Putin Oil Deal in the Works as Russia Oil Exports Resilient

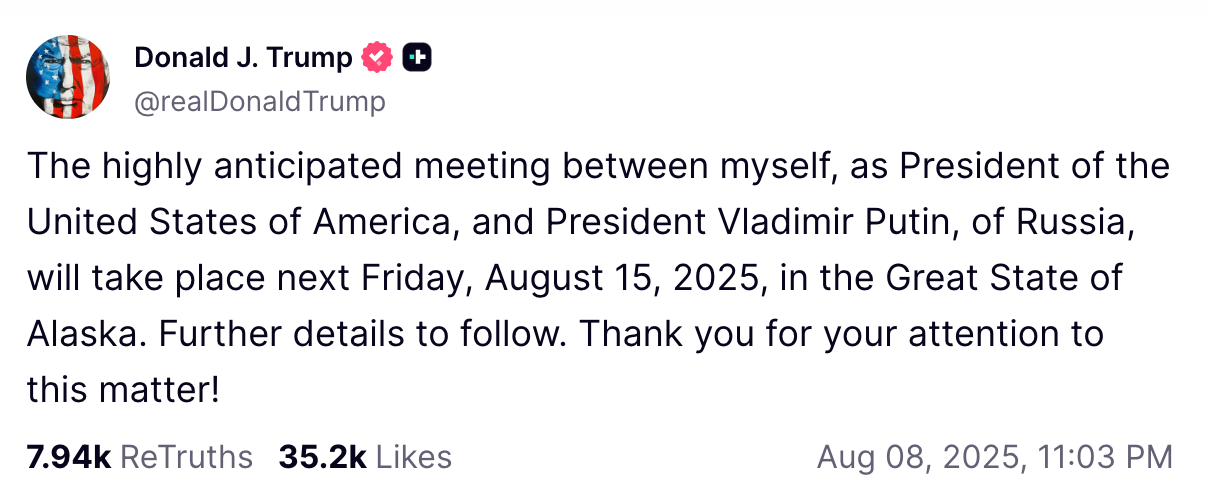

Anchorage — The meeting between US President Donald Trump and Russian President Vladimir Putin is confirmed for August 15 in Elmendorf-Richardson, a US military installation in Anchorage, Alaska.

The meeting is ostensibly about a potential ceasefire between Ukraine and Russia — but most likely it will end in an energy deal between the Washington and Moscow.

Oil has played a pivotal role in the Russia-Ukraine conflict, as well as helping to bring about a potential peace deal after President Trump threatened India with tariffs if it continued to purchase Russian oil (it's unknown how much much of the threat was real or theatre in co-ordinating behind-the-scenes face-saving access).

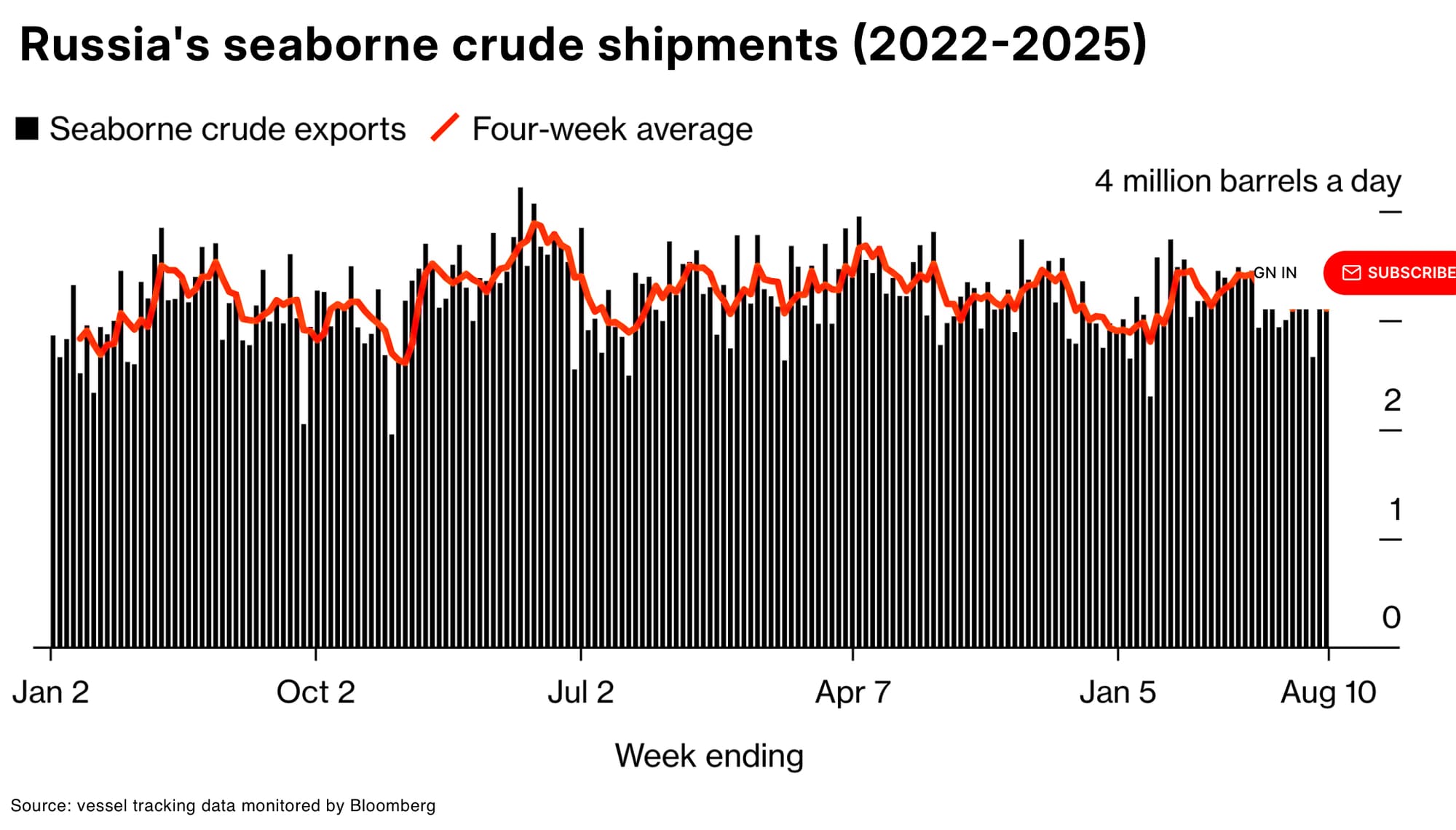

Russian seabourne oil product exports reportedly declined 6.6% in July, signaling shifts in shipping in buyer hesitation, notably as the EU set a new Russian oil cap.

However, Russia's oil exports remain comfortably within the average range seen so far this year.

Despite geopolitical strains, Russia’s oil exports remain resilient.

🗣️ "A total of 30 tankers loaded 23.31 million barrels of Russian crude in the week to Aug. 10, vessel-tracking data and port-agent reports show. The volume was up from a revised 22.72 million barrels on the same number of ships the previous week" — Bloomberg, Russia Keeps Crude Exports Flowing Ahead of Trump-Putin Summit

If Putin is feeling pressure from tanking exports—or wary of losing India as a customer—then diplomacy may offer a new channel to steady flows. Could Trump be positioned to reopen strategic markets faster, with Modi as his energy envoy?

According to Bloomberg, the recent fall in shipments to India could be reversed once the destinations of those vessels in the Unknown Asia and Other Unknown categories become clear.

Why Oil Markets Are Tense

- Reduced Russian exports + potential stabilization: If a deal boosts Russian output or streamlines routes, prices could soften. But talk of coordination adds a geopolitical edge, which markets love—or hate.

- India’s strategic leverage: As one of the few major buyers still importing Russian crude, India holds incredible bargaining power. A pivot away sends ripples across global price equilibrium.

- Supply vs. sanction dynamics: A thaw between Moscow and global buyers could derail sanctions-driven supply cuts, risk reintroducing low-cost barrels into the market—especially if OPEC+ remains disciplined.

Bottom Line

A Trump-Putin deal that allows Russia back into the global oil game—or, at least, reopens ties with India and other specific global markets—would ease pressure on the oil price that has been rising slowly but steadily in the last few months, just as US core inflation has ticked up. Trump's key platform is to keep inflation down by suppressing the oil price. This suggests some king of an energy deal is in the works.