Trump Authorizes Chevron to Restart Pumping Oil in Venezuela — can Caracas deliver?

WASHINGTON, D.C. — The Trump administration has formally authorized Chevron to restart oil production in Venezuela.

As reported by the Wall Street Journal and Bloomberg, the license — granted quietly this week — allows Chevron to begin pumping crude from joint ventures with state oil company PDVSA, and export it directly to the U.S.

In February 2025 President Trump revoked a license allowing Venezuela to export some of its oil through joint ventures between the state-run oil company and US oil giant Chevron, to the US despite sanctions.

Key to the new arrangement with Chevron is an assurance that no royalties or taxes will benefit the government of Venezuela’s socialist leader, President Nicolas Maduro. However, it is not certain how this will be guaranteed.

The move is part of a broader strategy by the Trump administration to secure heavy crude supply without tapping the Strategic Petroleum Reserve or increasing U.S. refinery dependence on the Middle East.

Why it Matters for Oil Markets

The license opens the door to an estimated 80,000–120,000 bpd of immediate production, with the potential to ramp toward 200,000–250,000 bpd over 12–18 months. While that’s small on a global scale, it’s significant for Gulf Coast refiners, which have struggled with a persistent shortage of heavy sour crude—the type Venezuela produces.

Refiners such as Valero and PBF have long favored Venezuelan barrels due to their compatibility with complex coking units. Since the 2019 sanctions, they’ve relied heavily on Canadian and Saudi blends, often at a higher premium.

🗣️ "The ban on Chevron never made sense, as our reports explained months ago. The primary loser is not Maduro but U.S. refiners, especially when US distillate inventories are near record lows as Canada export more oil form the West" — says Anas Alhajji, Everything Energy Daily Energy Report

📉 But Venezuela’s Oil Sector Is in Ruins

Venezuela holds the largest proven crude oil reserves in the world, estimated at approximately 303 billion barrels as of 2024.

The problem is that decades of mismanagement, corruption and sanctions have meant the country's oil pstream and midstream infrastructure has largely collapsed.

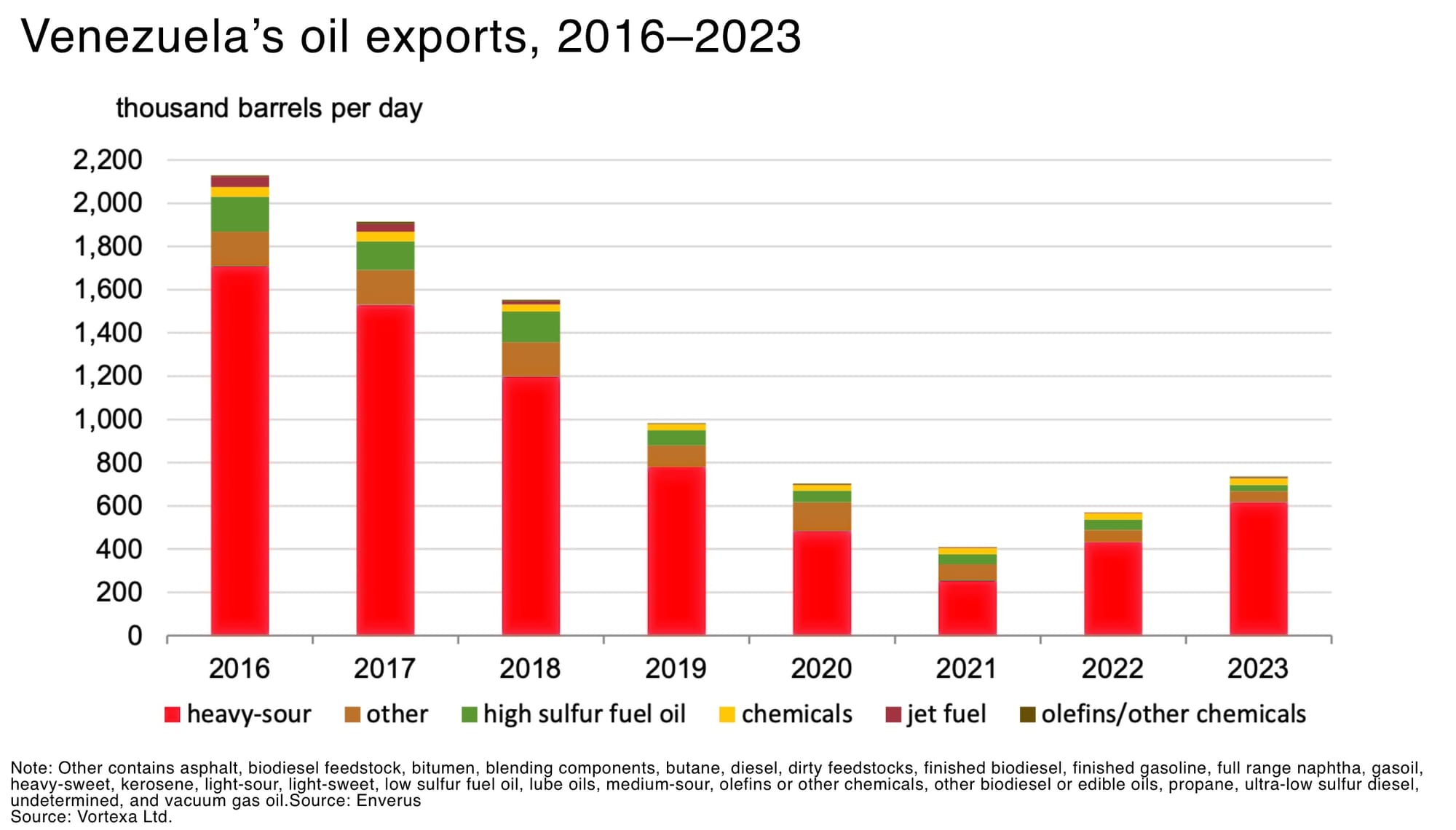

In 2016, Venezuela produced around 2.35 million barrels per day. By 2024, production had dropped, but exports saw a rebound, with an average of 772,000 barrels per day.

PDVSA’s facilities are plagued by power outages, equipment theft, and decades-old technology. Chevron’s joint ventures—Petroboscan and Petropiar—will require hundreds of millions in near-term capital just to stabilize flow, and billions more to scale production sustainably.

Geopolitics and Energy Strategy

The White House has framed the move not as a concession to Maduro, but as a pragmatic energy policy. Senior administration officials told The Washington Post that the U.S. needs alternatives to Russian and Iranian barrels, especially with OPEC+ maintaining supply discipline and U.S. shale growth slowing.

The main theme remains the same: Trump wants oil prices down.

Chevron, for its part, has lobbied for this outcome for years and is now the only Western major with legal and operational presence in Venezuela.

Bottom Line

Chevron is back in Venezuela. But the oil isn’t — yet.

Bringing even 200,000 barrels per day to market will require cash, equipment, labor, and stability — none of which Caracas has in ready supply. Still, in a tight global market, even partially restoring Venezuelan barrels shifts the short-term calculus for U.S. refiners and global heavy crude spreads.