Saudi Oil Exports Hit Record 7.5M bpd — Is the Price of a Barrel Headed for a Breakdown?

RIYADH / VIENNA — Saudi Arabia is flooding global oil markets with record-high crude exports, set to reach 7.5 million barrels per day (bpd) in July, according to shipping data cited by Reuters. The surge comes as OPEC+ raises their production ceiling and braces for another possible supply boost in September — testing the resilience of oil prices as Brent flirts with the $70 level.

While the Saudi Arabia's state-backed oil strategy signals confidence in global demand, it also raises fresh concerns of oversupply, particularly as refinery margins soften and macro headwinds persist.

🗣️ “Why has crude remained so resilient? ... Crucially, Trump not only delayed his ‘reciprocal tariffs’, but he also held positive talks with Beijing, which managed to defuse some of the market’s worst fears about trade tensions between the world's two biggest economies,” Ron Bousso, Reuters Energy Columnist.

🛢 OPEC+ Keeps Pumping — But Can the Market Absorb It?

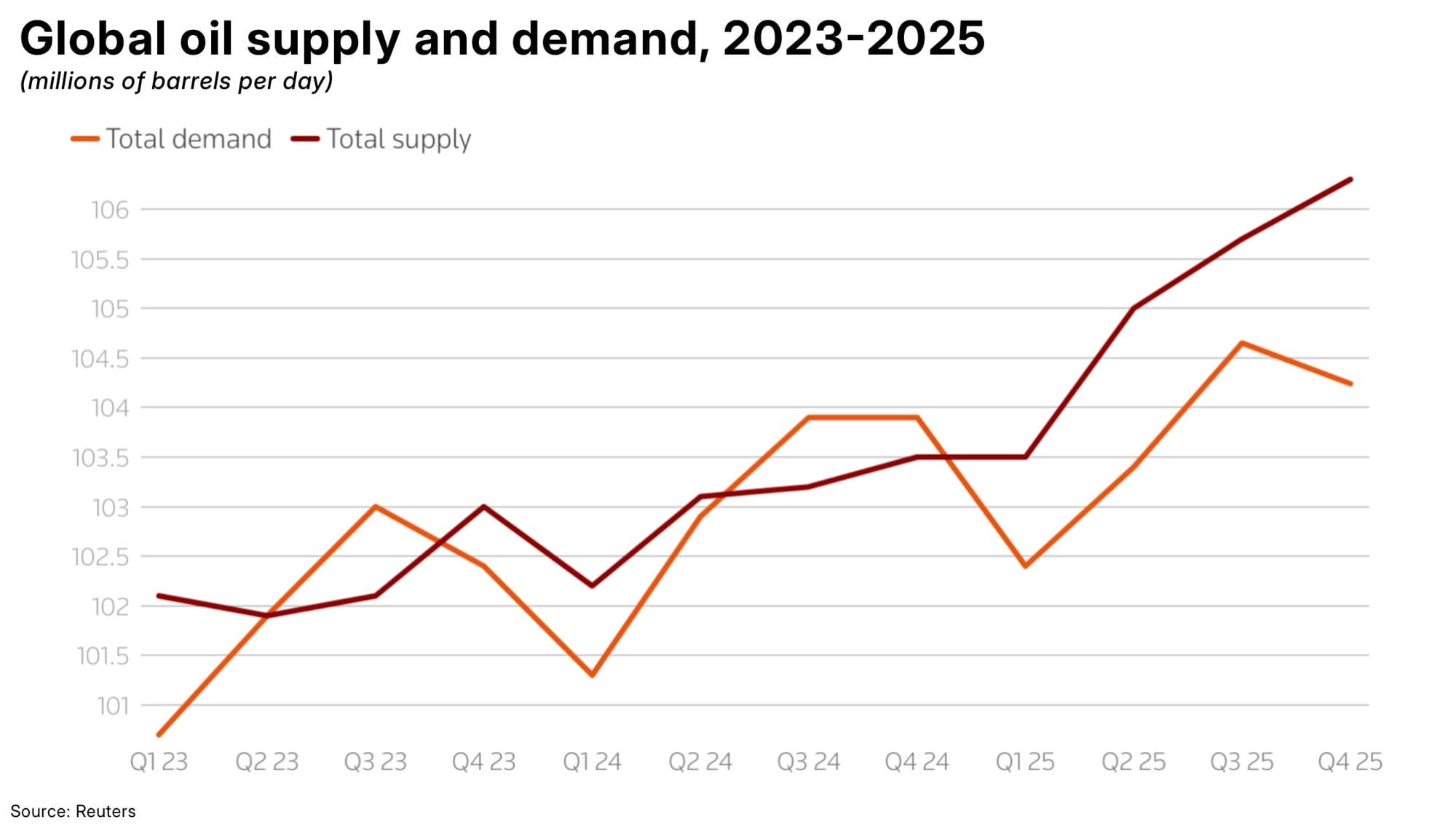

- OPEC+ supply set to grow by 2.5 million bpd between April and September, driven by phased unwinding of voluntary cuts. In September, Goldman Sachs expects a group of eight OPEC+ members to lift oil production quotas by 550,000 barrels per day.

- Saudi Arabia’s 7.5M bpd export level would be the highest since 2018, up nearly 1 million bpd from earlier this year.

- A fresh output increase is reportedly under consideration for the September OPEC+ meeting, as demand projections remain strong—but uneven

📊 IEA Adds a Twist: Market Tighter Than It Looks

In contrast to fears of a glut, the International Energy Agency (IEA) said in its July 2025 oil market report that the market is tighter than it appears. Despite the surge in production, rising refinery activity, especially in Asia, is absorbing barrels at a faster pace than previously modeled.

This “invisible tightness,” as the IEA calls it, may help put a floor under prices in the short term—but only if demand stays strong and inventory builds remain subdued.

🗣️ “Price indicators also point to a tighter physical oil market than suggested by the hefty surplus in our balances,” IEA, Oil Market Report July 2025

⚖️ Market at a Crossroads

- Brent hovered near $70 on Monday, while WTI edged up to $68.30, supported by geopolitical risk from potential U.S. sanctions on Russian oil exports.

- However, technical indicators and rising supply suggest downside risk unless demand surprises to the upside this summer.

- Investors are closely watching Chinese crude buying which have surged back to over 1.7mbd in June, rebounding from May’s low of 1.1mbd, U.S. gasoline drawdowns, and Saudi Aramco’s next OSP revision for signs of market stress or strength.

📌 Bottom Line

Saudi Arabia’s record-breaking export surge may mark the start of a critical inflection point for oil markets. With OPEC+ considering even more output and the IEA flagging hidden tightness, bulls and bears are once again locked in a battle over the price of a barrel.

The market’s next move hinges on one question: Can global demand keep up with the barrels Riyadh is now unleashing?