Saudi Aramco Hikes Oil Selling Prices — Signals Tight Market Ahead

RIYADH — July 7, 2025 — Saudi Aramco has raised its official selling price (OSP) for August crude exports. The state oil giant increased the price of its flagship Arab Light crude to Asia, its largest market, to $2.20 per barrel over the regional benchmark, up from $1.20 per barrel in July, and made similar upward adjustments for European and U.S. buyers.

The decision comes despite recent bearish sentiment and OPEC+’s own surprise 548,000 bpd production hike, suggesting Riyadh sees tight fundamentals returning, or is seeking to test buyers’ price tolerance amid a shifting demand-supply balance.

🛢 Why Aramco Is Raising Prices

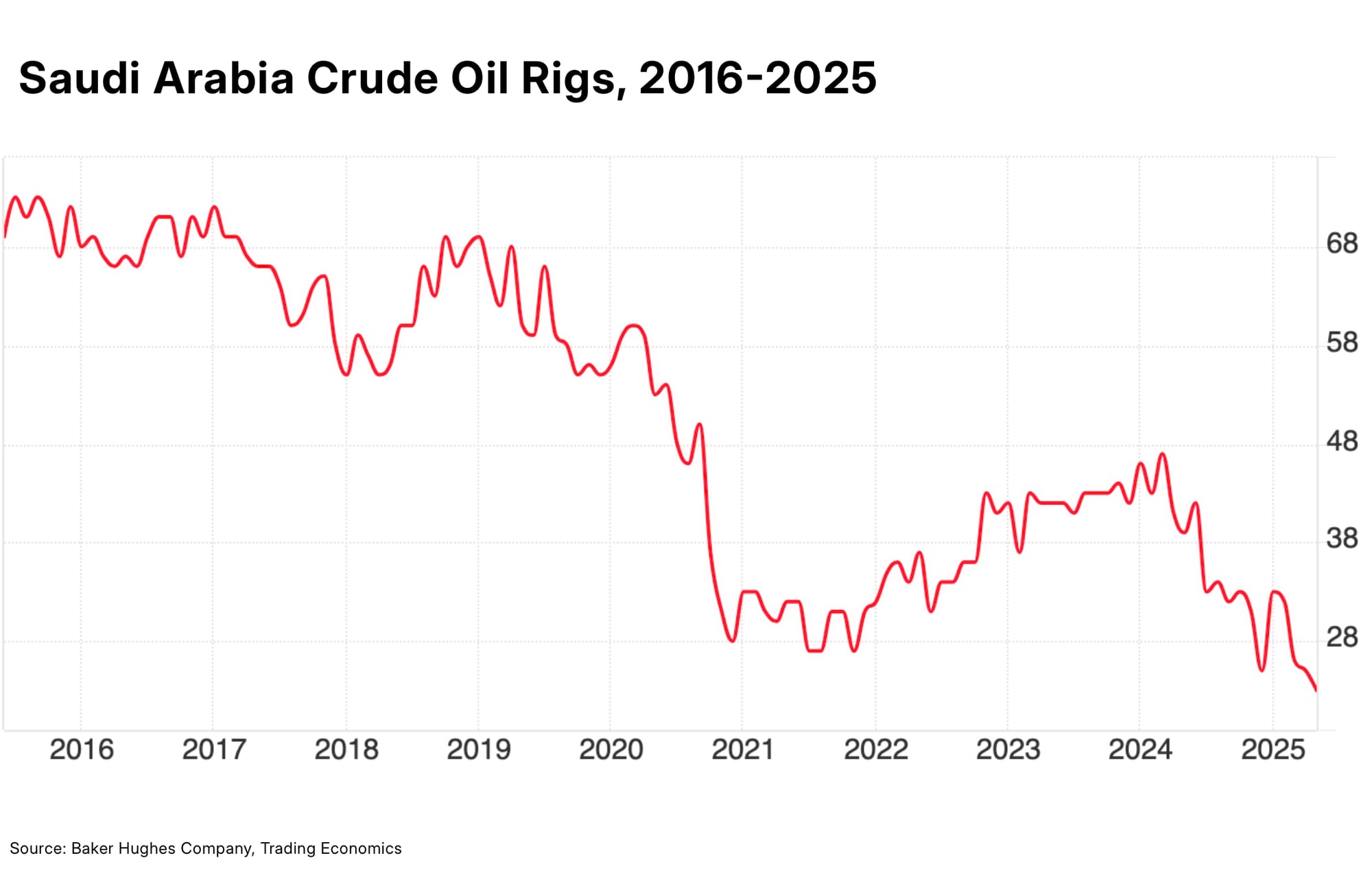

- Saudi Arabia’s own crude oil rig count has fallen sharply in recent months, reflecting internal caution about overproduction and fragile price support. According to the latest data, Saudi rigs dropped to below 20 in June, the lowest level for 10 years.

Aramco CEO, Amin Nasser, is recently reported as saying OPEC+ fields are depleting at a rate of 5.5% per year.

- Demand recovery in Asia: Refinery margins are improving, especially in India and China, as summer air travel, petrochemical demand, and industrial activity rebound.

- Supply discipline uncertainty: With some OPEC+ members (Iraq, Kazakhstan) overproducing, Aramco may be front-loading prices to capture value before a possible glut builds.

- Market confidence signaling: By raising OSPs, Saudi Arabia sends a clear message that it sees no immediate oversupply threat, putting the burden on other producers to stay in line.

📈 “Bullish oil,” said Josh Young, former Chairman of IronBridge.

📊 Market Impact

- Brent crude edged up 1.1% to $68.10 on the news, reversing some of last week’s losses triggered by the OPEC+ production increase.

- WTI also rebounded to $67.20, as refiners reassessed forward buying needs amid higher Gulf export benchmarks.

- Asian refiners face margin pressure, potentially tightening crack spreads if OSP hikes continue into September.

🔍 What This Means for Oil Prices

Saudi Aramco’s OSP hike puts upward pressure on global crude benchmarks, particularly in Asia, where Saudi grades are used as a pricing anchor.

If demand holds and OPEC+ avoids further non-compliance, the market could firm above $70 Brent by August. However, if refinery margins erode or economic indicators soften—especially in China—the aggressive pricing could backfire, opening doors for cheaper Russian Urals or U.S. light crude alternatives.

📌 Bottom Line

Saudi Aramco just reasserted its grip on the oil market—using pricing power, not production cuts, to shape global sentiment. By lifting official selling prices in the face of a fragile recovery and OPEC+ tensions, Aramco is testing the market’s resilience and signaling a tight oil balance heading into late summer.

If buyers absorb the hike without pushback, expect stronger pricing momentum—and a more bullish tilt to the price of a barrel.