Red Sea Attacks Escalate — Sinking of Greek Tanker Sparks New Fears for Oil Prices

GULF OF ADEN — A sharp escalation in Houthi maritime attacks in the Red Sea has reignited global fears over energy security after two Greek-flagged cargo ships have been attacked this week—the most serious disruption in months.

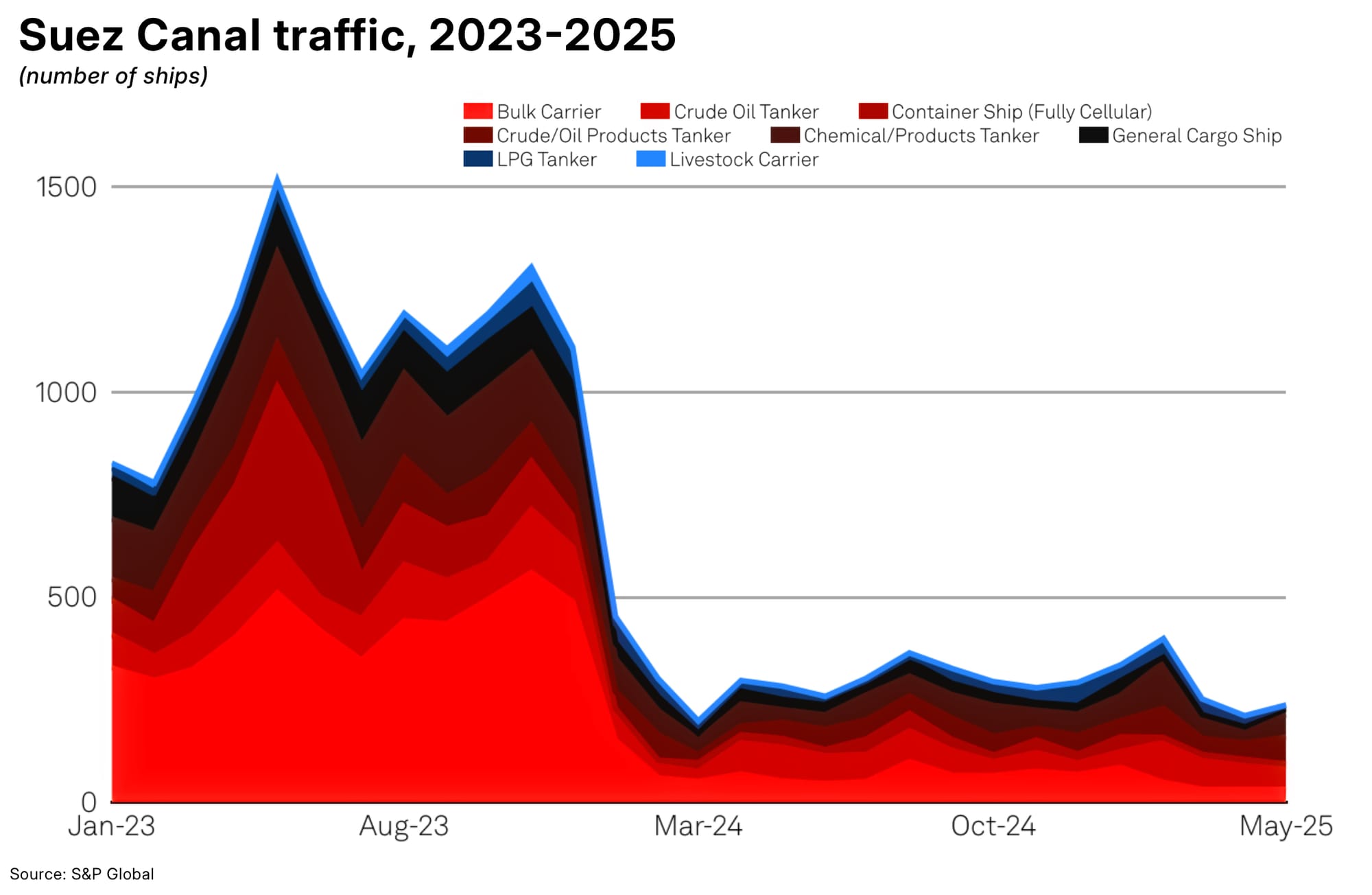

The rise in attacks has sent tremors through global shipping, with insurance premiums soaring (the cost of insuring a ship through the Red Sea doubled by Sept 2024) and tankers rerouting thousands of miles around Africa as Suez Canal transits have not recovered, straining supply chains and pressuring the price of a barrel of oil.

The Houthis attacked two ships over the last 48 hours:

- hitting the Magic Seas (IMO 9736169), a Greek-owned, Liberia-flagged bulk carrier. Gunfire was exchanged with onboard guards. The crew abandoned ship, with reports it has since sunk.

- a Greek-owned cargo ship, the Liberian-flagged Eternity C, was attacked in the Red Sea on Monday July 7, resulting in at least two crew members wounded and two missing.

It’s the latest in a string of strikes attributed to Iran-backed Houthi rebels, who continue to target international energy routes despite U.S.-led naval patrols in the region.

"Operators shift to safer lanes despite longer voyages and higher fuel use. Early nominations at Piraeus, Istanbul, and key hubs help mitigate premium risks," a bunker trader told S&P Global last month.

Why Are Houthi Attacks Increasing?

- Strategic leverage: With tensions between Israel and Iran simmering, the Houthis are using Red Sea attacks to maintain geopolitical relevance, stoking instability in a globally critical energy corridor.

- U.S. naval limits: Despite Operation Prosperity Guardian’s presence, U.S. and coalition forces have struggled to secure the Bab el-Mandeb Strait, a chokepoint for over 9 million bpd of crude and refined products.

The Real Cost of Avoiding the Red Sea

- Rerouted ships = longer journeys: Tankers now detouring via the Cape of Good Hope face 10–14 days of extra transit, increasing bunker fuel demand and delaying deliveries to Asia and Europe.

- Soaring marine insurance: War risk premiums are up 300%, with some tankers facing daily insurance costs over $100,000 per voyage.

- Strained global fleet: Tanker availability is tightening as ships are pulled into longer routes—creating ripple effects across U.S. Gulf exports, Asian refinery supplies, and European diesel inflows.

Why Oil Prices Haven’t Spiked

- Iran-Israel tensions easing: The Iran-Israel ceasefire has reduced immediate fears of full-scale regional conflict, helping cap crude price gains.

- OPEC+ overproduction: A surprise 548,000 bpd production ceiling hike from OPEC+ last week has introduced bearish oversupply pressure.

- Demand side remains cautious: With China’s imports flat and U.S. gasoline usage stabilizing, global consumption hasn’t surged enough to absorb higher freight costs.

📌 Bottom Line

The Red Sea is not just a shipping route—it’s a geopolitical flashpoint. The attacks on cargo ships marks a dangerous new phase in maritime warfare, one that could reshape oil supply lines for months to come.

While prices haven’t surged—yet—pressure is building: longer routes, rising insurance, tighter tanker availability, and escalating risk.

If another major vessel is hit or diplomatic tensions reignite, the ripple effects could be felt from West Texas to Singapore.