New 275-Mile Texas–Oklahoma Gas Pipeline Enters Open Season — A Pressure Valve for the Permian?

DALLAS, TX — July 2, 2025 — As oil rig activity in the Permian Basin slides to its lowest point since 2021, a new gas pipeline may offer long-overdue relief. Producers Midstream II, LLC has launched a binding open season for its proposed 275-mile Palo Duro Pipeline, aimed at clearing out the backlog of stranded natural gas that’s choking the economics of West Texas oil production.

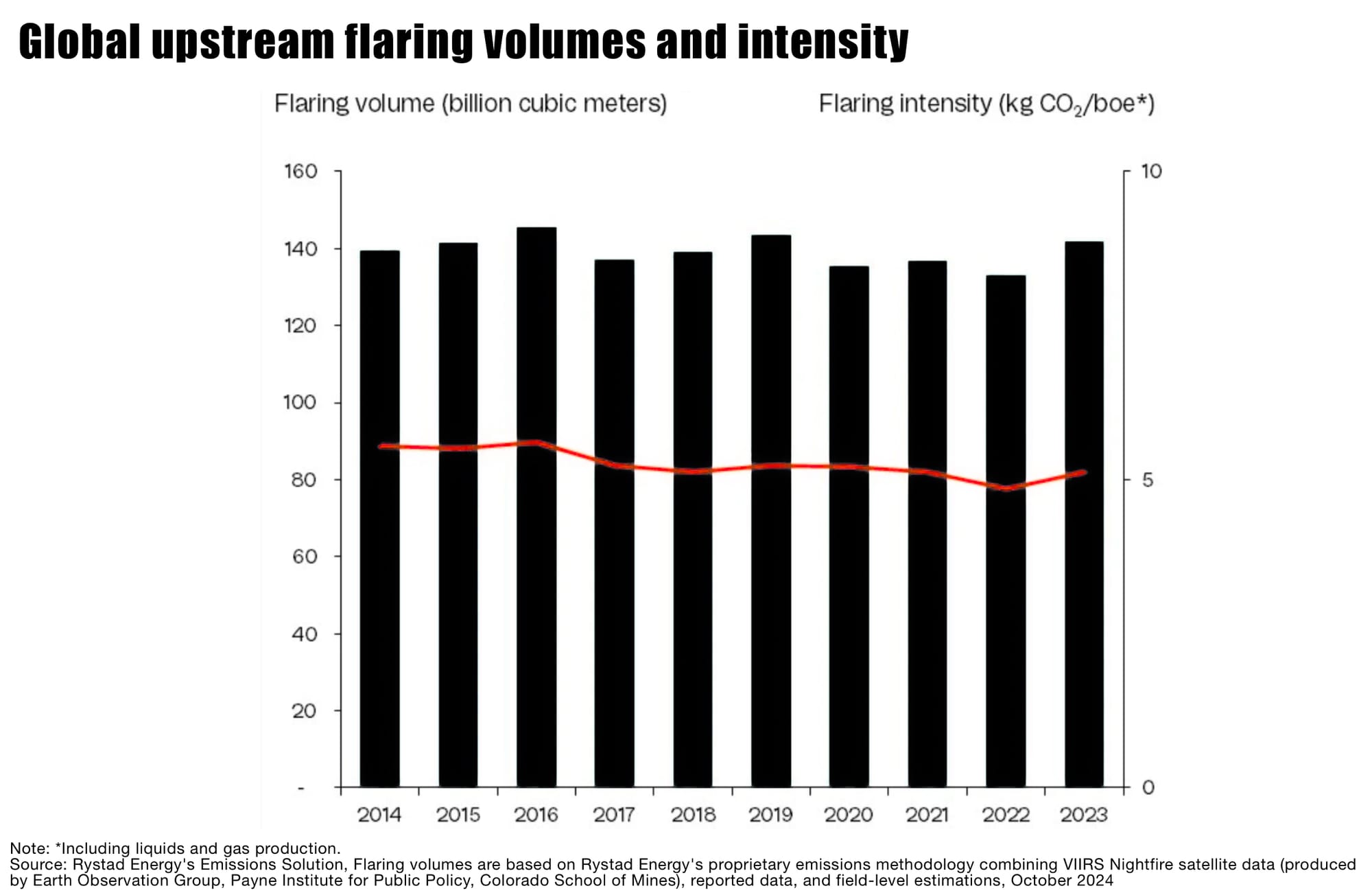

With associated gas flaring surging and regulatory pressure mounting, this project could revive drilling confidence by giving producers a reliable, low-risk exit route for their gas—and unlocking higher returns on oil.

Oil-First Take: Why It Matters for Permian Drillers

The Permian’s explosive growth in oil output has brought with it a parallel surge in associated natural gas—much of which currently lacks takeaway infrastructure, leading to flaring, waste, and depressed oil economics.

Rystad Energy forecast that Permian natural gas production will increase by 1.9 Bcf/d in 2024 and 1.0 Bcf/d in 2025, reaching an average of 25.8 Bcf/d in 2025.

- Without infrastructure, operators are forced to flare gas, which imposes regulatory penalties and ESG risks—and reduces the netback value of oil per barrel.

- Rig slowdown linked to gas takeaway constraints: Many oil producers in the Permian are sitting on undrilled locations because they can’t move the gas that comes up with the oil.

- Flaring restrictions mean production caps: High-GOR (gas-oil-ratio) wells risk curtailment under tightening state rules, limiting new oil development.

New pipeline = new drilling runway: The Palo Duro line could restore capacity headroom, letting operators bring rigs back online without regulatory or midstream risk and provide new takeaway capacity unlocks trapped value by reducing flaring and allowing operators to monetize gas instead of burning it off.

According to East Daley Analytics, the Permian Basin will gain 2.5 Bcf/d of natural gas egress capacity when Blackcomb Pipeline, Whitewater Midstream’s latest infrastructure project, comes online in 2026. Another Whitewater project, Matterhorn Pipeline, is due to start by the end of the month and also add 2.5 Bcf/d of takeaway.

The new pipeline to spark near-term growth in Permian oil production (see East Daley’s recent analysis, ‘Permian Oil is Primed to Pop’).

What’s in the Pipeline

- Route: From Nolan County, TX (Waha hub) to Wheeler County, TX, then into Western Oklahoma, connecting to seven interstate gas pipelines

- Infrastructure leverage: Repurposes existing 16-inch pipe and leases gathering header capacity—no new construction needed, enabling faster rollout

- In-service goal: Q1 2026

- FERC filing: Under Section 7(c) of the Natural Gas Act

- Open season: Runs June 30 – July 14

“The pipeline’s unique interconnectivity and strategic positioning creates a much-needed additional outlet for constrained Permian gas, while also supporting the rapid growth of AI-driven power solutions and other emerging sources of demand” said Matt Flory, Chief Executive Officer of Producers Midstream

What It Could Mean for Oil Prices and Rigs

- Reduces gas-related drilling delays: Operators can approve more rigs without worrying about forced shut-ins or flaring penalties.

- Improves oil economics: Trapped gas hurts full-cycle margins. Monetizing gas instead of flaring it could boost oil well profitability by $2–$4 per barrel.

- Supports stronger WTI basis pricing: More reliable gas takeaway supports overall market stability and tighter oil spreads in Midland vs. Cushing.

Bottom Line

The Permian’s oil rig count just hit 270—the lowest in nearly four years. While capital discipline plays a role, takeaway limitations are the hidden brake on activity. The Palo Duro Pipeline could relieve that constraint, unleashing new rigs and restoring drilling momentum in West Texas.

For operators eyeing 2026 project timelines, this pipeline could be the difference between stagnation and resurgence.