IEA Warns of Oil Glut — But Analysts Skeptical on Forecast

LONDON — August 13, 2025 — The International Energy Agency (IEA) has boosted its 2025 supply estimate to 2.5 million barrels per day (bpd)—up 400,000 bpd from just a month ago—thanks largely to OPEC+ revoking production cuts faster than anticipated.

This expected supply is set to continue as demand lags. Demand growth for 2025 is now pegged at 680,000 bpd, then slightly improved to 700,000 bpd in 2026—but still down from earlier projections—raising the specter of a widening global oil surplus, and expected to continue into 2026.

Meanwhile, refinery activity near record: Crude runs are set to hit 85.6 million bpd in August, supporting infrastructure but risking even deeper stockpiles.

📣 “Oil-market balances look ever more bloated as forecast supply far eclipses demand towards year-end and in 2026,” the Paris-based agency said. “It is clear that something will have to give for the market to balance” — IEA, Oil Market Report, August 2025

However many industry watchers remain unconvinced, pointing to uneven data and conflicting projections from OPEC and U.S. agencies.

Analysts Raise Their Eyebrows

🗣️ "I don't buy it. The IEA says the oil market is heading for its biggest glut since the Covid crash. It assumes that Saudi Arabia is stupid. It's another sales pitch for its renewable agenda, not a balanced read on supply and demand" — Art Berman, energy consultant and geologist

- Many oil analysts question the accuracy of the demand softening narrative, especially given unexpected refinery upticks in China and seasonal gasoil demand.

- The growing contradictions between IEA, OPEC, and EIA forecasts—particularly on how much oil is actually in storage—have sparked industry skepticism.

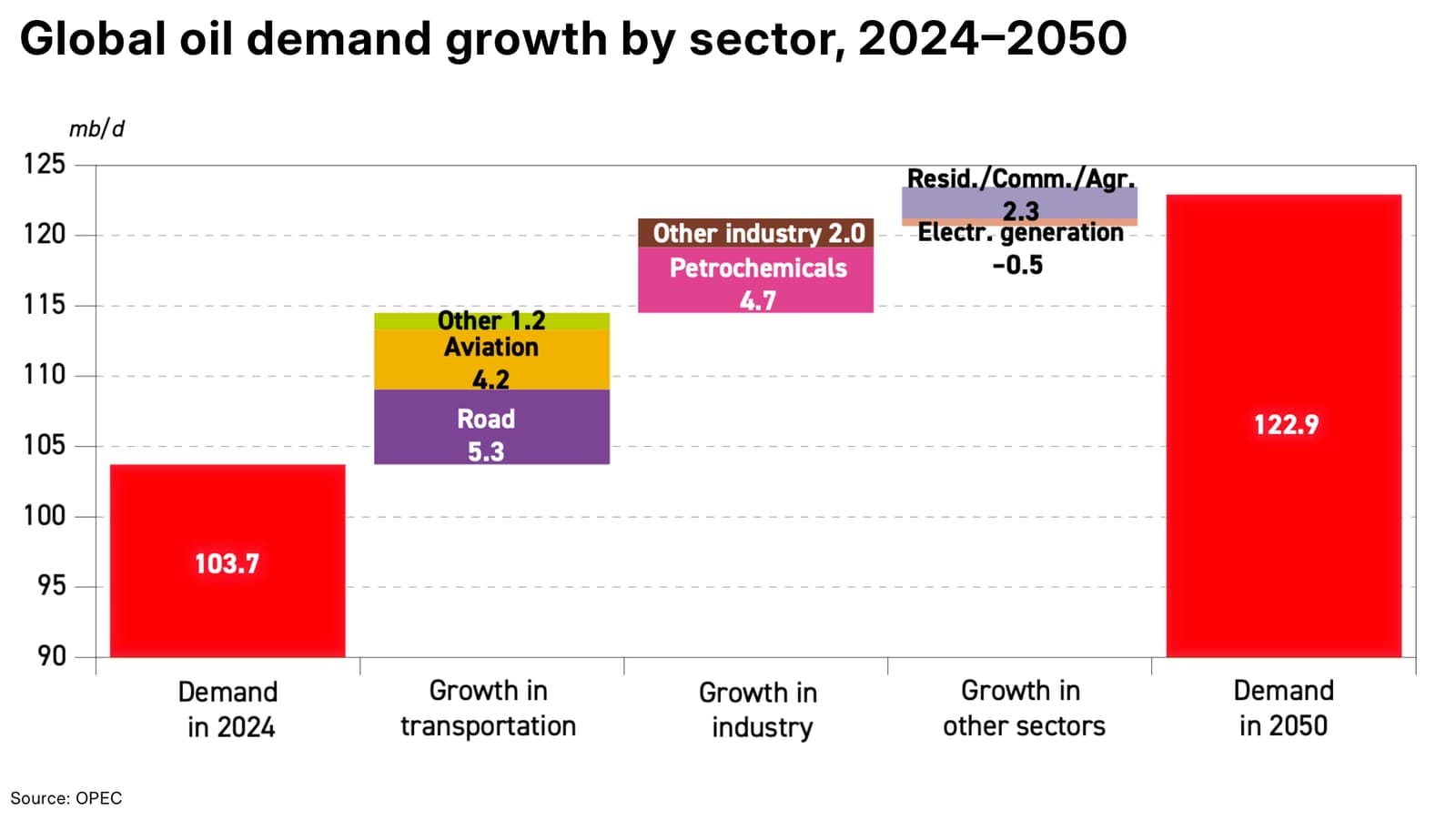

For example, oil demand will grow by roughly 19% to reach almost 123 million barrels a day (bpd) by 2050, according to OPEC's latest report World Oil Outlook 2025.

- Some argue the IEA may be overstating supply risk and understating demand resilience—particularly in markets where inventories remain tight and refining margins are high.

What A Glut would Means for Oil Prices

- Price pressure mounting: With supply forecast to vastly outpace demand, prices could stay depressed unless geopolitical shocks intervene.

- Volatility has returned: Surplus fears may weigh on WTI and Brent—already trading in the mid-$60s—but uncertainty is keeping a floor under prices.

- Watch the deviation risk: If demand turns out stronger than expected—or if sanctions disrupt OPEC+ supply—the IEA’s bearish view could swiftly reverse.

Bottom Line

The IEA’s latest oil forecast signals a looming glut that threatens to reshape markets—but analysts remain wary. Forecasts from OPEC and the EIA are decidedly more bullish, and refining and storage data isn’t as clear-cut as the IEA suggests. For oil traders and energy watchers, one thing’s certain: pricing may hang on who gets the demand call right.