EU Pledges $750 Billion in U.S. Energy Imports—But Can It Deliver?

UPDATE: the EU has admitted it doesn’t have the power to deliver on a promise to invest $600 billion in the US, only hours after making the pledge at landmark trade talks — as Brussels has no authority over such private sector investment.

BRUSSELS — in a landmark July 27 deal between President Trump and EU Commission President Ursula von der Leyen, Brussels committed to buying up to $250 billion annually in U.S. crude, LNG, refined fuels and energy-related commodities over the next three years ($750 billion over the remaining three years in Trump's term)—an unprecedented push to supplant Russian supplies and pivot Europe toward the U.S. energy orbit.

Why It Matters

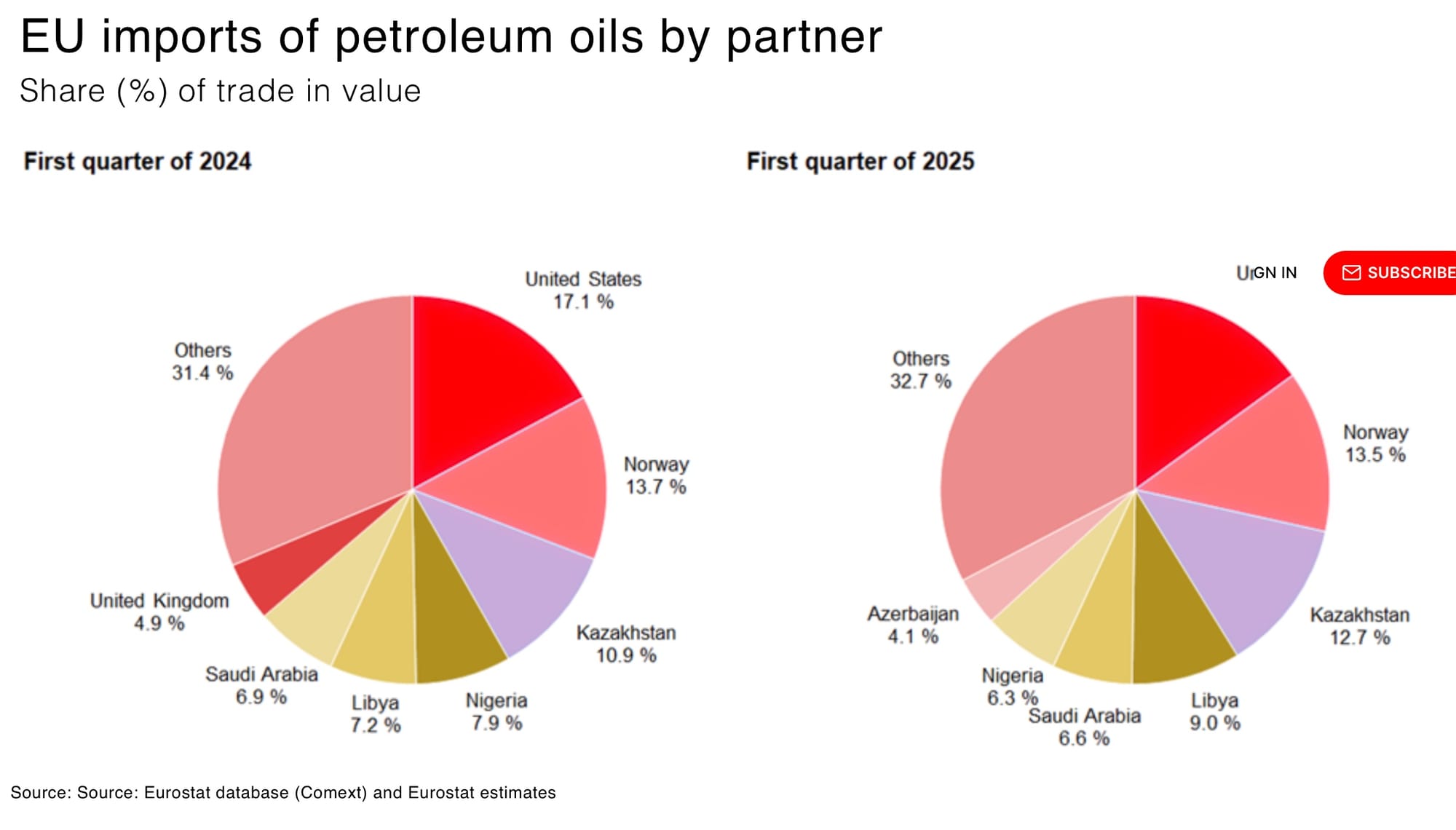

This commitment marks a continued pivot for Europe from Russian energy ties, and, increasingly, Chinese renewable energy sources, while deepening geopolitical alignment with Washington.

The Numbers Don’t Add Up

EU energy imports from the U.S. last year totalled just $64.5 billion—including ~$40 billion in crude (~573 million barrels), ~$21.8 billion in LNG, and $2.7 billion in metallurgical coal—barely a quarter of the new target. Even assuming full-scale upscale, U.S. annual exports ($165.8 billion across oil, LNG and coal) fall short.

🗣️ "This is a delusional level of imports that the EU has virtually no chance of meeting, and one that U.S. producers would also struggle to supply" says Clyde Russell, Reuters Commodities and Energy analyst

Challenges on Both Sides

- For EU buyers: logistics, infrastructure and pricing hurdles make absorbing such volumes unlikely. Refining capacity, regasification terminals, and shipping constraints limit scale-up.

- For U.S. suppliers: ramping export volumes fast enough is unlikely. 2024 output spans just ~1.45 billion barrels of crude and ~87 million tonnes of LNG—stretching supply would displace other customers and disrupt global flows.

Direction of Travel: Strategic Alignment Wins

However, even if $250 billion a year proves unrealistic, the political signalling matters. Europe is formalizing an energy realignment—moving decisively away from Russian hydrocarbons (once nearly 40–50% of imports) under REPowerEU—and toward U.S. trade and supply. That shift gives U.S. oil and gas producers a longer-term marketing narrative, even if the short-term volumes fall short.

🗣️ "Purchases of US energy products will diversify our sources of supply and contribute to Europe's energy security. We will replace Russian gas and oil with significant purchases of US LNG, oil and nuclear fuels" says EU President von der Leyen

Takeaway

Brussels’ pledge is powerful geopolitically. But behind the optics lie hard limits: supply‑side capacity, infrastructure bottlenecks, and shaky detail on delivery mechanisms. The deal matters because it resets Europe’s energy axis toward Washington—but the execution risk is high, and oil markets should treat the headline figure as ambition, not actual barrels.