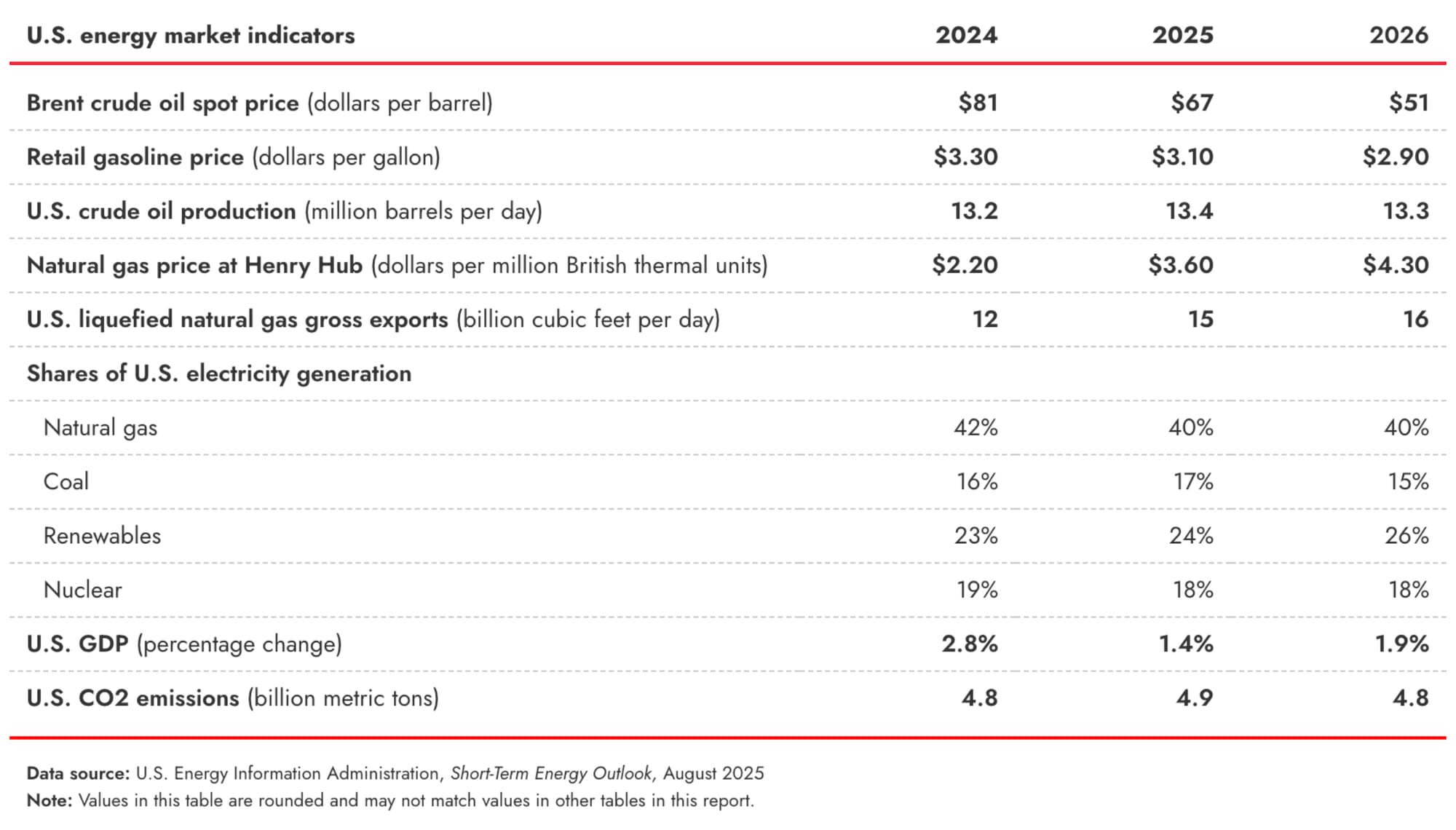

EIA forecasts oil below $60 in Q4 2025 — first quarter with average prices that low since 2020

WASHINGTON D.C. — The U.S. Energy Information Administration (EIA) projects Brent crude prices to dip below $60 per barrel in the final quarter of 2025—and average near $50 per barrel through 2026.

These are levels not seen since the pandemic-driven lows of 2020.

Behind the fall: global oil supply is set to outpace demand, as OPEC+ unwinds production cuts and inventories build, reshaping the industry’s fundamentals.

Why It Matters

- OPEC+ — a coalition of major oil-producing nations — will end its coordinated output cuts by September 2025, a full year earlier than planned.

- EIA forecasts most global oil production growth to come from OPEC+ countries, shifting the supply landscape.

- Crude oil inventories in the US are already showing signs of increasing: by 3.0 million barrels during the week ending August 8, after dropping by 3 million barrels in the week prior, according to new data from the U.S. Energy Information Administration (EIA). However, this is 6% below the five-year average for this time of year.

- U.S. crude oil production, which hit record highs in 2025, is expected to slow as producers respond to low prices — the number of rigs in the Permian Basin is already its lowest since 2021.

- And, Saudi Arabia needs oil prices above US$90 to balance its budget, according to the International Monetary Fund (IMF).

🤨 Analysts Are Skeptical

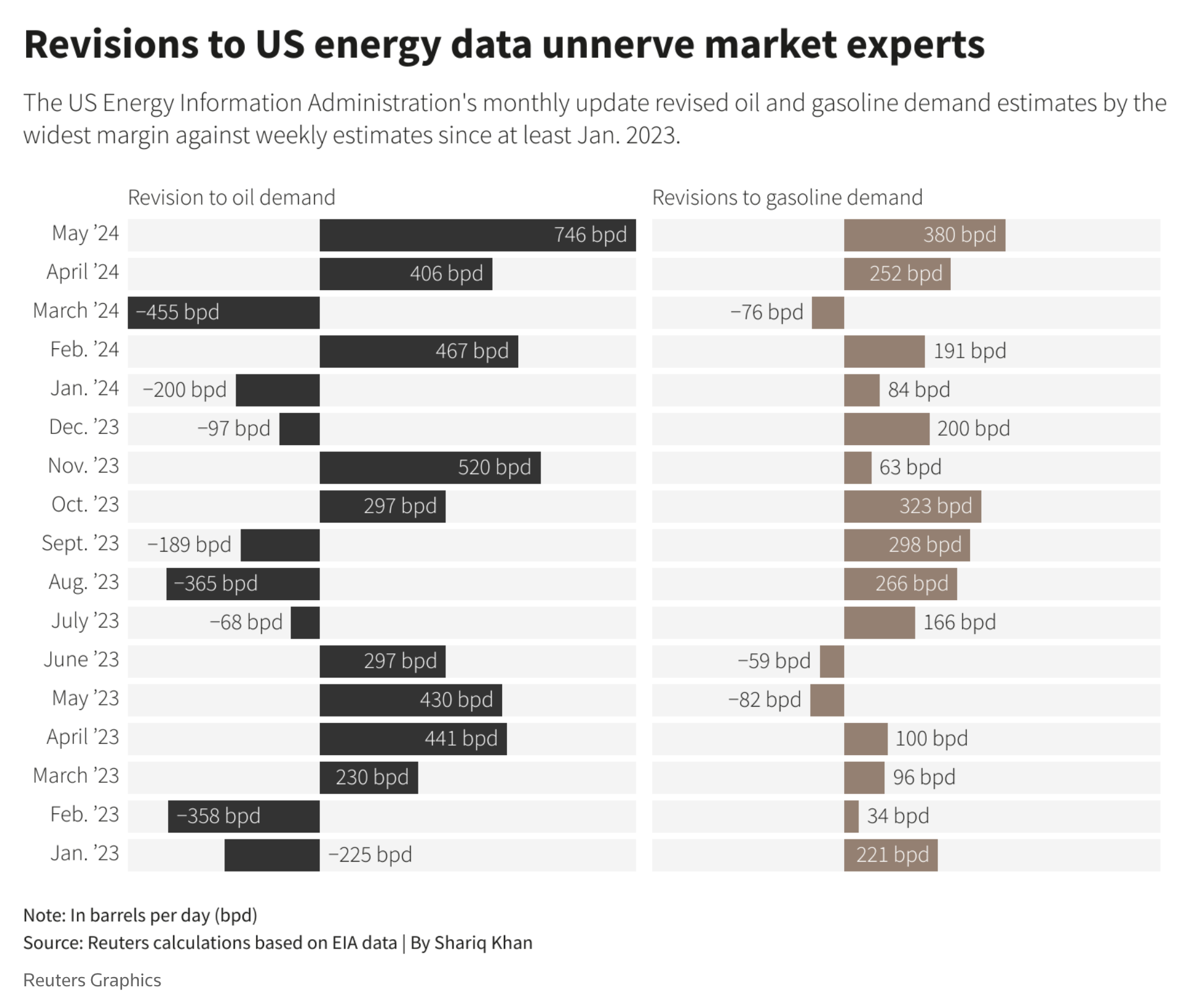

There is concern, however, some skepticism about the forecast from EIA, especially after large revisions unnerved market participants.

For example, revisions flipped the tally of U.S. oil demand to a seasonal record of 20.8 million bpd in May, 800,000 bpd higher than the weekly estimates. Similarly in April, oil demand was revised higher by 400,000 bpd from the weekly estimates.

"It's a trend that's a little concerning to me," GasBuddy analyst Patrick De Haan told Reuters.

🛢️ Industry Impact

Despite the skepticism, the forecast will have an impact:

- OPEC+’s decision injects fresh uncertainty into global energy markets, as producers weigh the risks of oversupply.

- U.S. producers may pull back on drilling and well completions, with EIA projecting a drop in output to 13.3 million barrels per day in 2026.

- Rising inventories can lead to volatile market conditions and influence investment decisions across the sector.

- Geopolitical factors — such as the Israel-Iran ceasefire and Russia-Ukraine tensions — could disrupt supply forecasts and alter the balance.

Key Facts

- OPEC+ production forecast: most growth will come from member countries for the first time since 2023.

- U.S. oil output: record highs in 2025, expected to decline in 2026.

- Inventories: projected to grow rapidly, adding downward pressure on prices.

- Uncertainties: trade negotiations, geopolitical tensions, and potential changes in OPEC+ strategy.

🗣️ “There’s a lot of uncertainty in the petroleum market. In the past, we have seen significant drops in oil price when inventories grow as quickly as we are expecting in the coming months,” said EIA Acting Administrator Steve Nalley.

📌 Bottom Line

If the EIA is correct, then OPEC+’s early move to ramp up production—and a potential economic slowdown—sets the stage for a global supply surplus, forcing the industry to adapt and watch for unexpected shocks.