China’s Crude Oil Imports Surge 11.5% in July

BEIJING — China’s crude oil imports increased 11.5% year-on-year in July, reaching 43.69 million metric tons, or about 10.31 million barrels per day (bpd), according to data from China's General Administration of Customs.

The boost reinforces hopes of a demand rebound from the world’s largest oil importer, offering a bullish signal for global markets still grappling with OPEC+ supply increases and U.S. geopolitical volatility.

Volumes dipped slightly from June’s 10.44 million bpd, the year-on-year increase suggests Chinese refiners are cautiously ramping up buying amid signs of economic stabilization, recovering margins, and efforts to restock inventories ahead of peak autumn demand.

📊 The Numbers Behind the Signal

- July 2025 Imports: 43.69 million tons (~10.31 million bpd)

- July 2024 Imports: 39.20 million tons (~9.25 million bpd)

- Change: +11.5% YoY, according to the General Administration of Customs

- Jan–Jul 2025 Total Imports: 304.3 million tons, down 2.2% YoY—still below last year’s pace

The month-on-month softness compared to June reflects both base effects and refinery maintenance season, but traders say the headline year-on-year surge is the market’s key focus.

🗣️ "Independent refiners bought heavily in June, building up inventories, so their immediate demand in July was lower," said Muyu Xu, senior crude oil analyst at Kpler told Reuters.

🛢 Why It Matters for Oil Prices

China’s oil demand is one of the largest swing factors in today’s market. With OPEC+ planning further production hikes and U.S. exports stable, any sustained increase in Chinese buying could:

- Tighten physical crude markets and bolster Brent and WTI benchmarks

- Support medium sour and Russian ESPO crude prices, which are heavily discounted but favored by Chinese independents

- Ease oversupply fears from rising Saudi and Russian output

🏭 Refiners Rebalance

While state-run refineries have slowed throughput in recent months due to weaker domestic margins, independent “teapot” refiners in Shandong province have been steadily increasing Russian crude intake. This is driven by both price competitiveness and easing inventory pressure, according to Platts and Kpler tracking data.

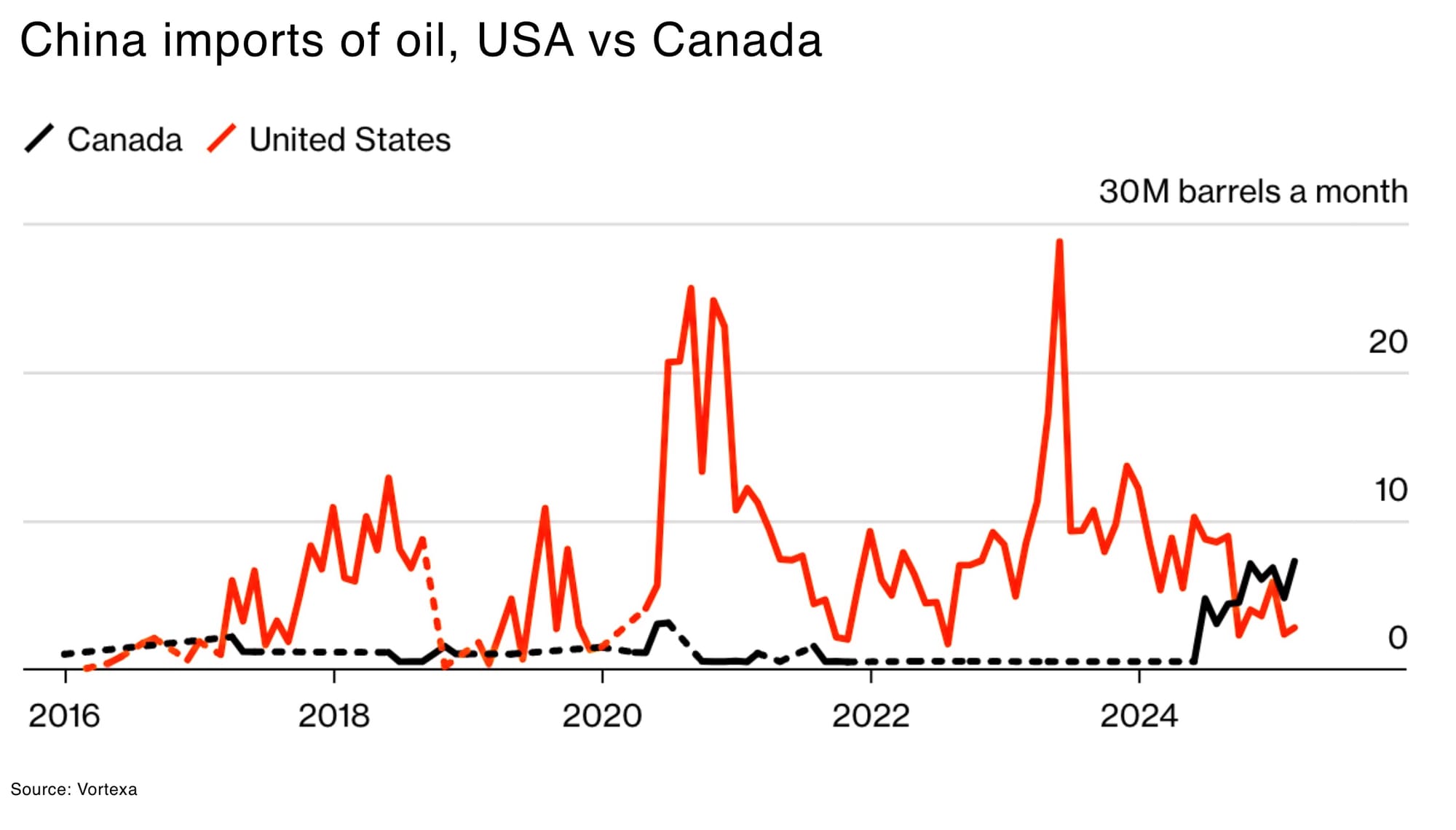

🇨🇦 Pivot to Canada

China is also pivoting away from importing oil from the US as the trade war rumbles on, and is instead pivoting to Canada — with Chinese refineries cutting purchases of US oil by up to 90% in April 2025.

📌 Bottom Line

China’s July oil import jump is more than a data point—it’s a sentiment anchor for traders watching demand signals in a fragile global recovery.