China Oil Demand Surges as US Inventories Fall, Trump Says $64 Oil “Is Great”

Washington D.C. — the latest economic data from the world’s two biggest economies is putting oil back in the spotlight:

- China is burning through more crude than it has in over a year

- while U.S. stockpiles just saw another steep drop

And now, Donald Trump is weighing in where he wants the oil price: “Hope to get oil down a little more… $64 a barrel is great.”

Oil Man in Texas on China oil demand and US inventories falling

📈 U.S. and China Data Surprise to the Upside

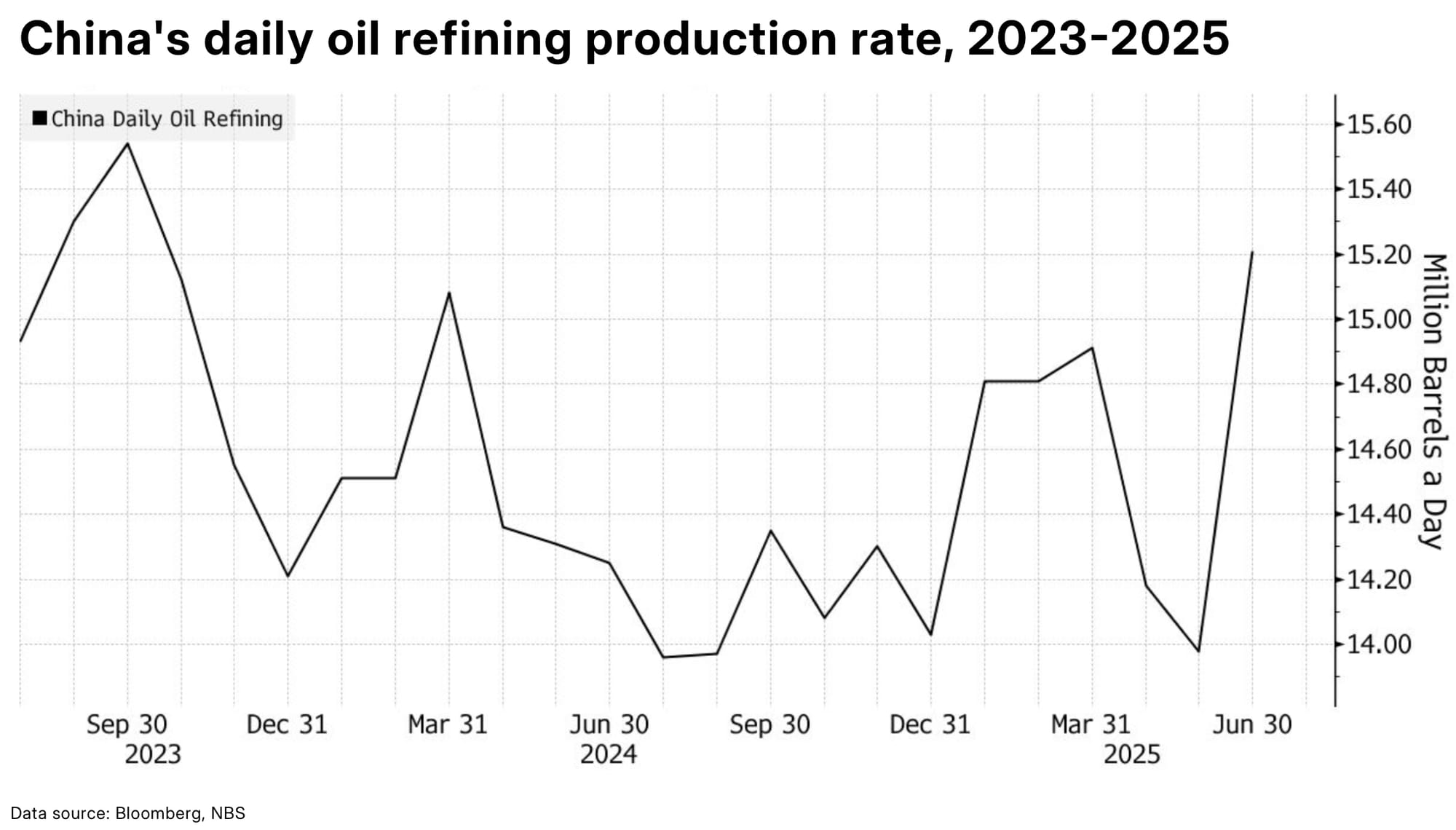

China's refiners processed up 15.2 million barrels per day in June, up 8.5% from the same time last year, and the strongest since 2023, according to Bloomberg's calculations from Chinese data — suggesting China's industry and travel demand are recovering.

🛢 U.S. Crude Inventories Fall 3.9 Million Barrels

US crude inventories fell 3.9 million barrels in early July, according to EIA data, well above analyst estimates of a 552,000-barrel draw

Gasoline and distillate inventories also declined slightly, despite higher refinery runs. The draw adds to evidence that domestic consumption remains solid, especially heading into peak summer travel season.

🗣️ “Investors cheered the rebound in oil prices, as tight supplies and strong demand brightened sector prospects,” noted Finimize.

🧠 Goldman Sachs Ups 2025 Forecast, Warns on 2026 Pullback

Goldman Sachs has raised its 2025 Brent price forecast by $5 to $66 per barrel, citing reduced spare capacity and resilient demand. However, it held its bearish 2026 view, projecting a drop to $56 due to expected OPEC+ unwinding and rising global stockpiles.

“The faster-than-expected normalization in spare capacity rebalances the risks around our price forecast,” Goldman analysts wrote in a July 14 note.

🗣 Trump: $64 Oil “Is Great”

Speaking during a bilateral meeting with Bahraini Crown Prince and Prime Minister Salman bin Hamad Al Khalifa at the White House, Donald Trump weighed in on oil markets:

“Hope to get oil down a little more,” Trump said. “$64 a barrel is great.”

His comments come as WTI hovers near that level, raising speculation about potential political pressure on U.S. producers or the SPR heading into the 2026 election cycle.

💡 Why It Matters

- Bullish: Demand outperformance and inventory draws suggest physical tightness.

- Bearish: Political comments could foreshadow intervention; OPEC+ supply increases remain a wildcard.

- Watchlist: Permian production trends and U.S. rig counts will be key in assessing longterm supply.